capital gains tax indonesia

General capital gain tax rate is 20. Taking a look at the capital gains tax rates in Indonesia compared to other countries in the Asia.

Know More About Capital Gains Tax On Property Sale Bq Prime

Capital gains are generally assessable at ordinary tax rates together with other income of the individual.

. Share deal Capital gains received by an entity in a share deal are subject. However certain types of venture capital companies are not required to pay tax on capital gains under particular circumstances. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory asset.

Indonesia plans to charge value-added tax VAT on crypto transactions and capital gains at a rate of 01. Income is defined as any. The exceptions are sale of land and buildings and exchange-traded.

The tax treatment on capital gains would then be subject to the domestic tax laws of each state as governed by Article 21. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

Capital gains taxes. NRI Advisory Services provides Income Tax Return in Indonesia with an excellent reputation for delivering world class services If you are searching for Capital Gains Tax Indonesia then. There were three significant changes to the tax treaty namely the.

However gains from the transfer of land and buildings are not. In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. The normal rate of corporate income tax is 25.

Updating the DTA can further enhance Singapores status as a hub for international investments into Indonesia. Tax rate is reduced to 5 in case of supply of residential apartment and the land attached to it. The sale of shares listed on the Indonesian stock exchange is subject to a final tax at 01 percent of gross proceeds.

151 rows Capital gains are subject to the normal CIT rate. The treaty does not discuss capital gains. Capital gains derived by an individual are taxed as ordinary income at the normal rates.

The tax rate is 20. For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. Tax on Capital Gains.

The property is directly and jointly owned by. The liable party is the entity that benefits financially from the gain. Capital gains are generally assessable at standard income rates.

The transfer of titles to land and buildings under an asset. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value. The valued-added and capita-gains taxes will take effect on May 1.

The settlement and reporting of the tax due is done on self. Indonesia Highlights 2022 Page 2 of 10 Corporate taxation Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax.

Accelerating Success Asia Capital Markets Investment Services Pdf Free Download

Seychelles Most Commonly Used Tax Efficient Vehicles Ppt Download

Pdf Do Tax Structures Affect Indonesia Economic Growth Semantic Scholar

Starting May 1 Indonesia Will Impose A 0 1 Cryptocurrency Vat And Capital Gains Tax Coincu News

Latvian Government To Put 20 Capital Gains Tax On Cryptocurrency Transactions Latest Crypto News

List Of Countries By Tax Rates Wikipedia

Capitalism In Indonesia Becomes More Savage During The Pandemic Observer

Corporate Income Tax Rate And Facility Capital Gains Tax Income Tax Filing Taxes

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

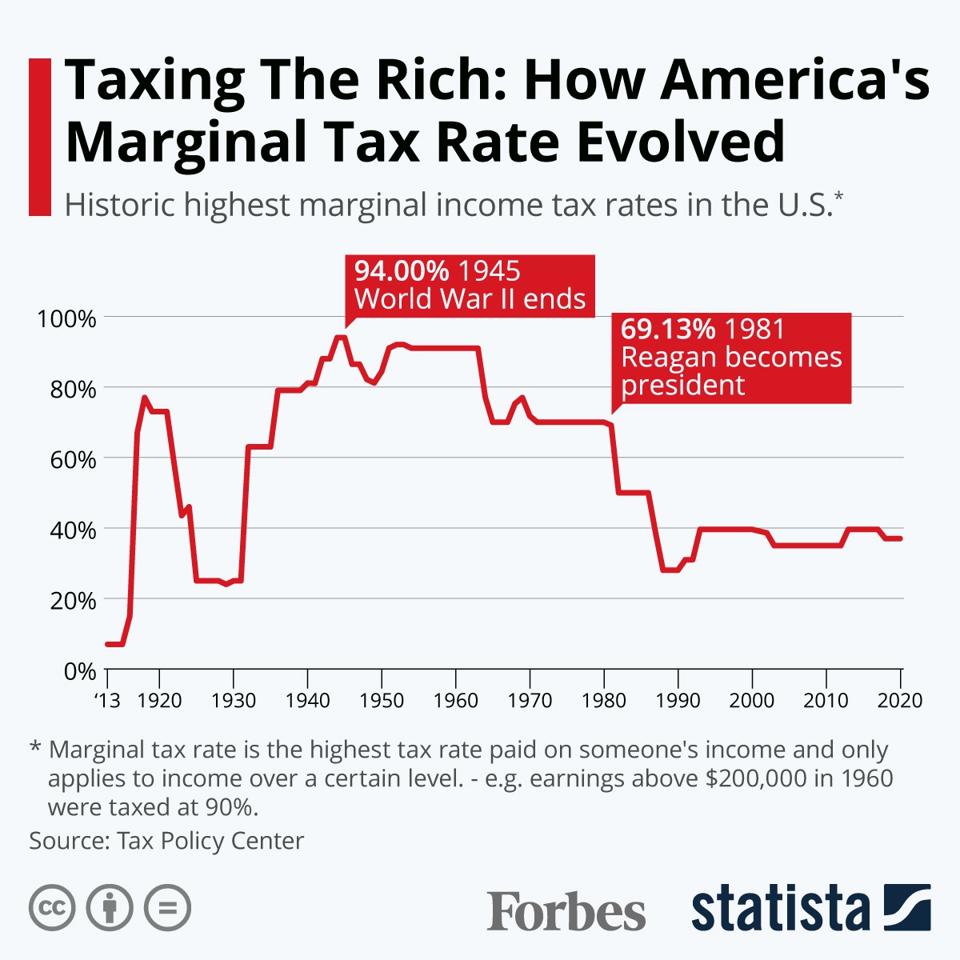

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Understanding Capital Gains Tax In Singapore Acclime Singapore

Deutsche Bank Indonesia Teams With Xceptor To Automate Tax Processes For Post Trade Settlement A Team

Starting May 1 Indonesia Will Impose A 0 1 Crypto Vat And Cgt News 01 Apr 2022 Crypto News Coincu News

Top 8 Things To Know About Taxes For Expats In Indonesia

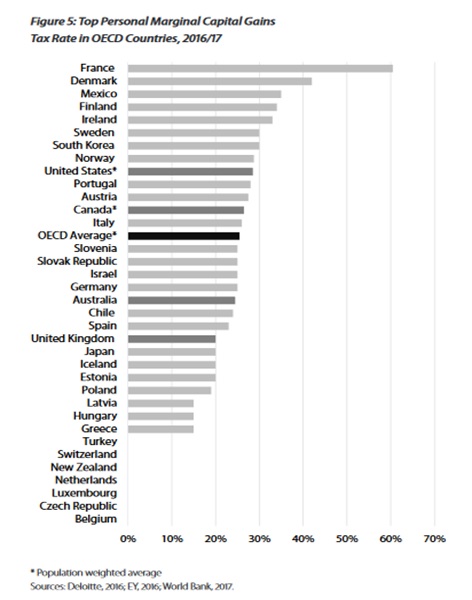

Entrepreneurship Growth And Capital Gains Taxation

Pdf The Need For Three Tier Tax Reform

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation